Irs social security calculator

For incomes of over 34000 up to 85 of your retirement benefits may be taxed. Social Security website provides calculators for various purposes.

Calculating Taxes On Social Security Benefits

Social Security taxable benefit calculator.

. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. We dont save or. Less than 25000 your Social Security will not be subject to federal income tax.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. If you earn more than the earnings test exempt amount then Social Security will need to withhold at least part of both your retirement benefits. If SS benefit exceeds 34K then taxable portion is 85 of your SS benefits.

Between 25000 and 34000 up to 50 percent of your Social Security benefits will be taxed at. Tax deferred retirement plans tend to increase tax liability on social security benefits. Enter total annual Social Security SS benefit amount.

For 2022 its 4194month for those who retire at age 70. For the purposes of taxation your combined income is defined as the total of your adjusted gross. The Tax Withholding Estimator doesnt ask for personal information such as your name social security number address or bank account numbers.

Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity. With a my Social Security Account You Can Check Your Application Status Much More. Fifty percent of a taxpayers benefits may be taxable if they are.

The self-employment tax rate is 153. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement.

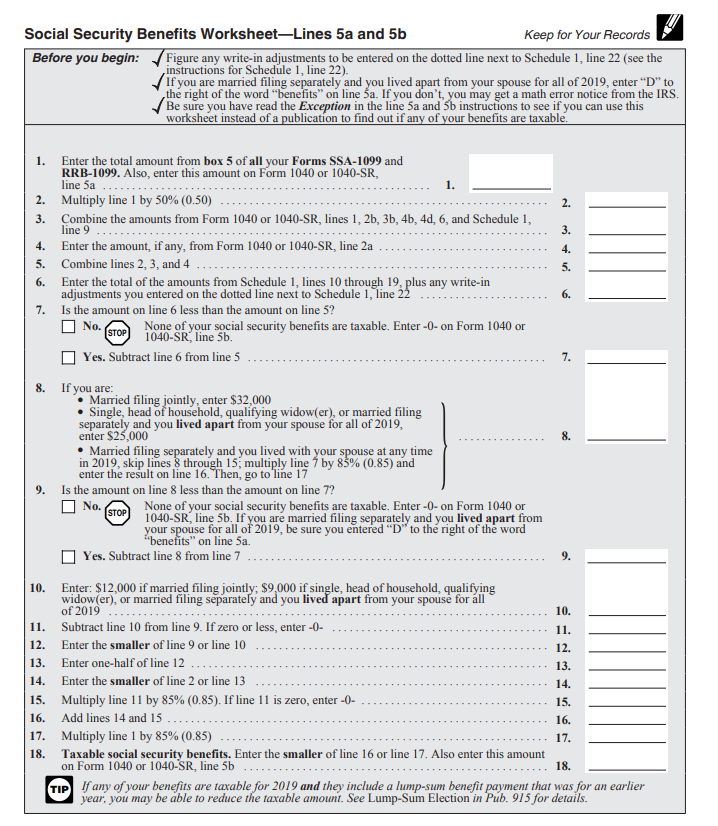

The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator. Box 5 of any SSA-1099 and RRB-1099 Enter taxable income excluding. Yes there is a limit to how much you can receive in Social Security benefits.

SS benefit is between 232K 44K then taxable portion is 50 of your SS benefits. Thats what this taxable Social Security benefits calculator is designed to do. Ad Create Your my Social Security Account To Review Your Social Security Statement Today.

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. Between 25000 and 34000 you may have to pay income tax on. The maximum Social Security benefit changes each year.

A new tax season has arrived. The rate consists of two parts. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Our Resources Can Help You Decide Between Taxable Vs. While they are all useful there currently isnt a way to help determine the ideal financially speaking age at which. The Social Security tax rate for both employees and employers is 62 of employee compensation for a total of 124.

The tool has features specially tailored to the unique needs of retirees receiving. The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099 Social Security Benefit. Give you an estimate of how much youll have to pay in taxes on your monthly benefits.

Before you use this. Learn How Much You Will Get When You Can Get It and More With the AARPs Resource Center. The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits.

Use this calculator to see. With your my Social Security account you can plan for your future by getting your personalized retirement benefit estimates at age 62 Full Retirement Age FRA and age 70. The Social Security tax rate for those who are.

Ad Calculate The Best Age to Claim and How to Maximize Your Social Security Benefits. Will your social security benefits be taxable. So benefit estimates made by the Quick Calculator are rough.

You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules.

Calculating Taxable Social Security Taxes On Social Security Benefits Part 2 Of 2 Youtube

Form 1040 Line 6 Social Security Benefits The Law Offices Of O Connor Lyon

Tax Withholding For Pensions And Social Security Sensible Money

Social Security Tax Torpedo

Resource Taxable Social Security Calculator

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Social Security Benefits Tax Calculator

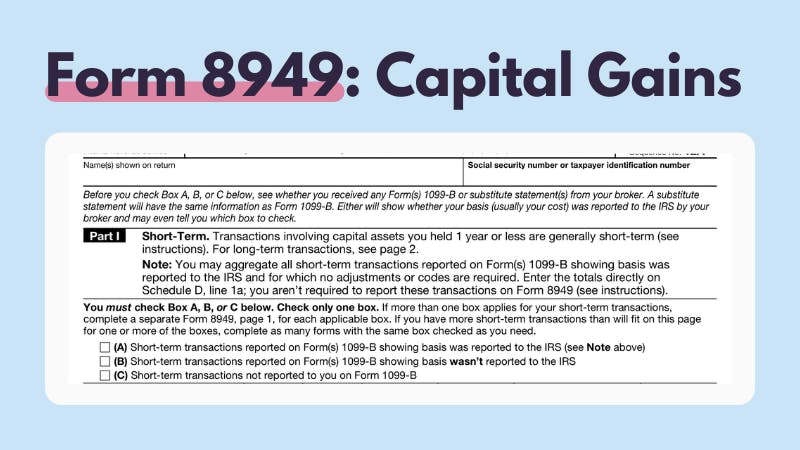

Irs Crypto Tax Forms 1040 8949 Koinly

:max_bytes(150000):strip_icc()/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)

Is Social Security Taxable

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Social Security Benefits Tax Calculator

Test Your Knowledge Of The Irs Tax Withholding Estimator Bds Financial Network

Calculator For 2018 Irs Publication 915 Worksheet 1 Frugalfringe Com

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Taxable Social Security Benefits Calculator Youtube

Taxable Social Security Calculator